The International Monetary Fund today delivered an unexpectedly brighter economic forecast, revising its global growth projections upward for 2025 and 2026. In its latest World […]

Central Banks Face Policy Dilemma as Core Inflation Proves Persistent

In a challenging turn for global monetary policy, central banks are grappling with a persistent and stubbornly high core inflation rate, threatening to derail a […]

Europe aiming to get a slice of the car battery market

Sweden tools up against the US and Asia with its own Gigafactory Just south of the arctic circle is not where you’d expect to find […]

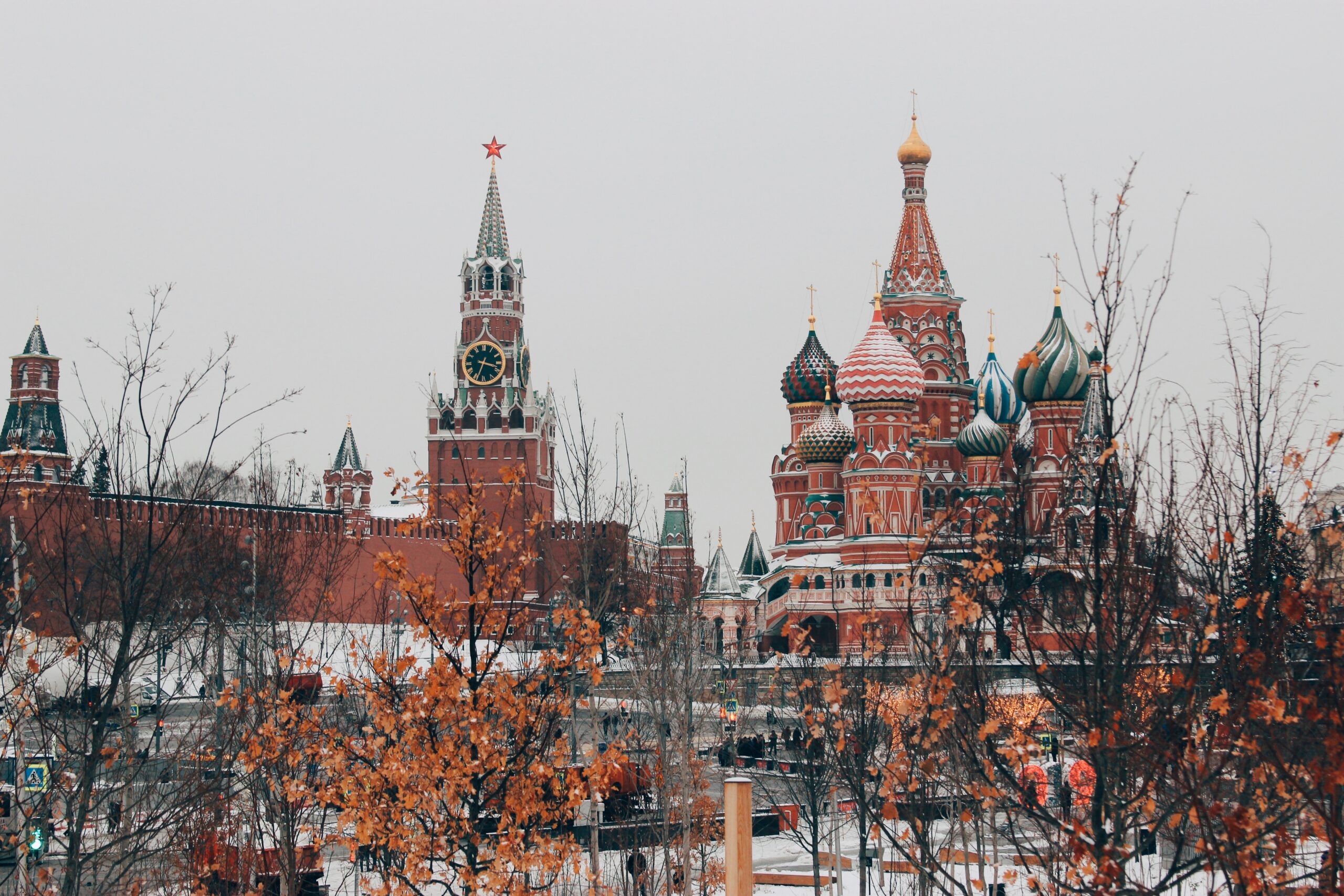

Biden Imposes Strict Sanctions on Russia

The Biden administration has announced a series of strict sanctions against Russia. These measures are designed to target the Russian economy and have been sanctioned […]

What rising interest rates mean for the consumer

The Federal Reserve recently raised interest rates for the second time this year, increasing the federal funds rate by a quarter point to a range […]

Nobel Prize-winning economist predicts pain for the housing market

Robert Shiller, the Nobel Prize winning economist, has predicted that despite the current buoyancy of the housing market, prices will eventually drop. Speaking to Yahoo […]

French vineyards devastated by worst weather for 30 years

One of France’s major export businesses has been devastated by a severe frost that has affected over 80% of the country’s vineyards. French winemakers were […]

Peloton shares plummet as company issues product recall

Shares of Peloton Interactive Inc. plummeted on Wednesday after the company announced it was voluntarily recalling 125,000 Tread and Tread+ treadmills. The recall comes in […]

The top business scandals of 2020

In a year when the news was dominated by the global pandemic, business scandals that would have normally made front-page headlines in the business press, […]

Joe Biden’s economic dream team

America’s economy is creaking under the strain of the global pandemic. Joe Biden has vowed to fix this, starting by passing a $2 trillion stimulus […]